Money and Death

Share :

On October 31, 2024, Flourish Financially hosted a thought-provoking webinar titled Money & Death: The Emotions of Inheritance & Other Scares, led by Dr. Sophie Jablonski, Positive Financial Psychology Practitioner, and Minna Schmidt, Financial Wellbeing Coach.

Together, they addressed a deeply emotional yet often overlooked topic—navigating the complex feelings around inheritance and the impact it can have on our financial choices.

1. Understanding Inheritance Beyond Money

Dr. Sophie set the stage with an essential reminder: inheritance is often an emotional experience as much as a financial one. It often arrives during times of loss, adding layers of grief, responsibility, and, in some cases, family conflict. Minnaunderscored that inheritance reflects love, legacy, and sometimes unresolved family dynamics. “People often don’t realize how profoundly emotions can influence financial choices,” she explained, “especially when we're already vulnerable.”

They noted that for women in midlife, these feelings can be intensified. Dr. Sophie explained that many women juggle multiple transitions, from career shifts to personal transformations, and inheritance can amplify these life changes. “Some see it as a gift, while others feel burdened by the sudden responsibility. It’s normal to feel conflicted,” she assured.

Minna shared that for some, there’s also the understanding that not everyone will receive an inheritance, and others may even have to financially support their parents or loved ones in retirement. “It’s important to acknowledge that the experience of inheritance varies widely and that privilege plays a role here,” she said.

2. Handling the Emotional Shockwaves of Inheritance

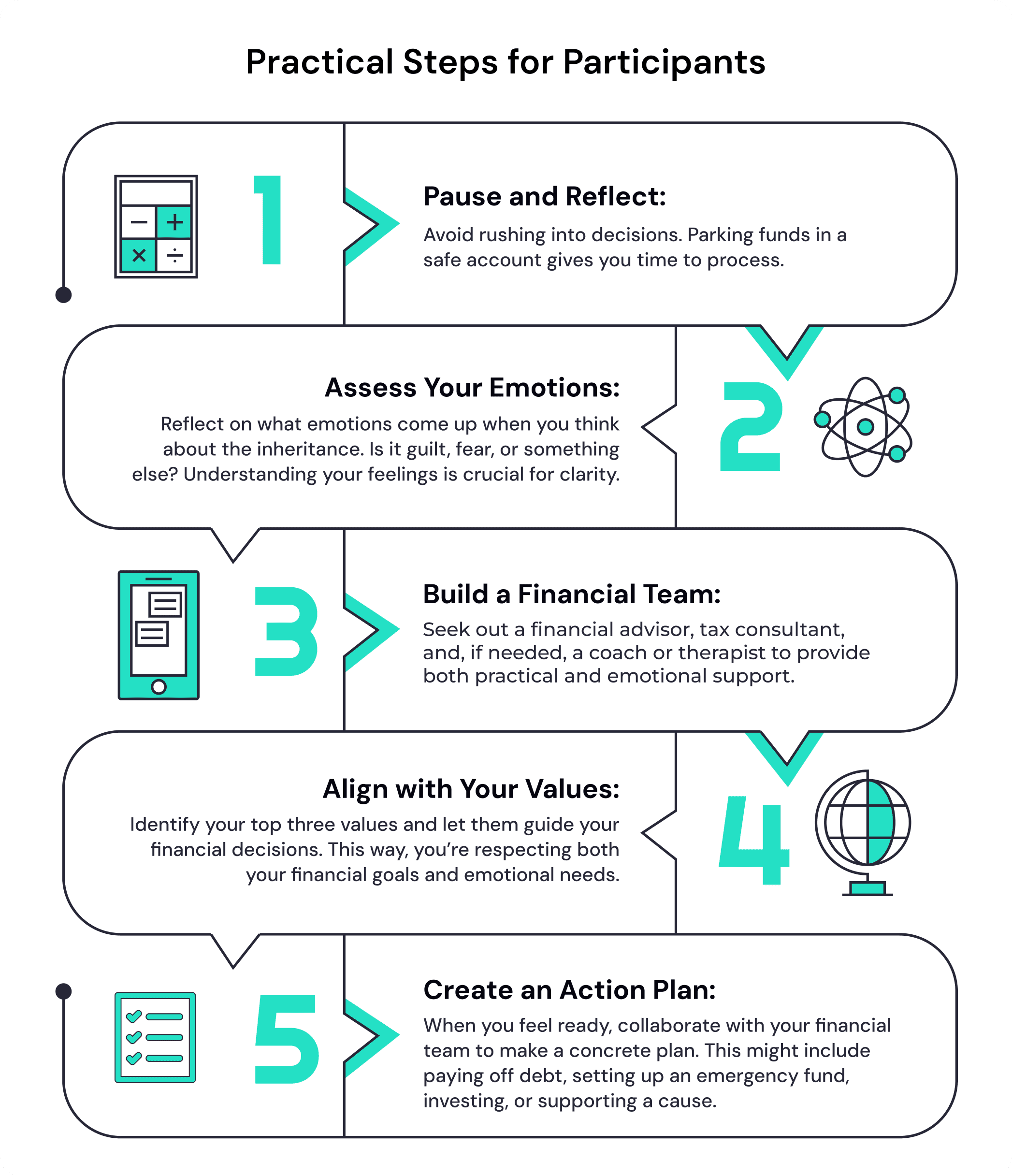

As Dr. Sophie pointed out, inheritance conversations often remain taboo until the money arrives. This delay can lead to intense feelings like relief, guilt, or confusion. She described how these emotions frequently appear for women in midlife who may already be managing menopause, family changes, or career transitions. “Sometimes the best thing we can do is to pause and process,” she recommended.

Introducing the concept of cognitive dissonance, Dr. Sophie explained how receiving an inheritance can clash with long-held beliefs. “We suddenly find ourselves with more financial resources than we’re used to,” she shared. This can create an internal disconnect, especially if our beliefs don’t align with our new financial reality.

Minna added that, “the arrival of an inheritance can feel strange or even surreal when you finally see the funds in your bank account. Many people feel pressured to make big financial decisions right away, but that’s a misconception.” Instead, she suggested parking the funds in a safe, low-risk account and taking time to adjust. “This breathing space can prevent financial mistakes,” she said.

3. Facing Guilt, Fear, and Responsibility

Dr. Sophie and Minna explored some of the most common emotions people experience with inheritance:

Guilt: A frequent reaction to inheritance is guilt, with people questioning if they “deserve” the money. “I see this in my clients,” said Dr. Sophie. “Guilt can drive people to spend impulsively to rid themselves of the money, or it can cause financial paralysis.”

Fear: Fear of making the wrong decisions with inheritance is another common challenge. Minna shared an example of a client who inherited a significant amount from an uncle. This unexpected gift triggered unresolved feelings of grief and guilt, along with a strong sense of responsibility to use the money “correctly.” After listing values-driven uses for the funds, such as investing for her children’s future, the client found peace with her choices.

Minna added that the pressure to honor the legacy of the deceased can also be intense, leading to decision paralysis. “This process is emotionally charged,” she said. By creating a list of possible uses for the inheritance, people can reduce stress and focus on choices that align with their values.

4. Building a Financial and Emotional Support System

Dr. Sophie and Minna stressed the importance of building a strong financial support system. “You don’t have to handle everything alone,” said Dr. Sophie. She recommended finding a financial advisor, a tax specialist, and even a therapist or coach to help manage both practical and emotional aspects of inheritance.

Minna pointed out that family dynamics can complicate inheritance conversations, especially if there’s any disagreement. “In cases of disputes, consider a neutral mediator or family law attorney,” she advised, emphasizing that emotions can run high and a professional third party can facilitate a fair discussion.

5. Changing Your Mindset: Money as a Tool, Not a Burden

A core message from Dr. Sophie and Minna was that money can be a positive tool, not a source of fear or guilt. Minnaemphasized the importance of not feeling pressured to use the money “perfectly” or to satisfy the presumed wishes of the person who left it. “This is your money now,” she explained, encouraging participants to make choices that support their well-being.

Dr. Sophie reinforced this message by highlighting the role of emotional intelligence around money—recognizing how fear, shame, and guilt can shape financial choices and taking steps to manage these emotions.

Prompt for Reflection: “Have you ever felt fear or guilt related to money?”

If you resonate with these challenges, you might find that coaching and emotional support can help you navigate inheritance more peacefully, enabling you to make empowered financial choices.

Other Blogs